Jammu & Kashmir e-Stamp Paper Online - Fast Delivery

Product details

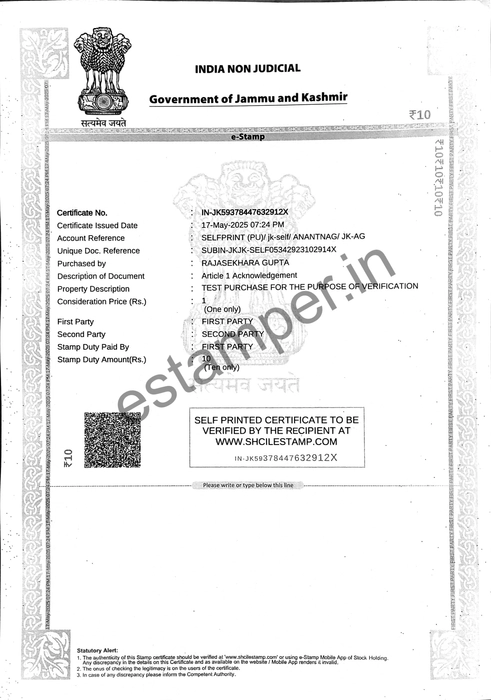

Order Jammu & Kashmir Stamp Paper Securely Online

Digital e-Stamp for Agreements, Affidavits, Leases in J&K

Compliant, Fast Delivery, Trusted Service

Instant PDF on WhatsApp or Physical Copy

Legal, Secure, Tamper-Proof Documents

Introduction

Experience the ease of getting stamp papers online with eStamper. Our fast and reliable service ensures you receive your required stamp papers within just 15 minutes of placing an order. Choose between a digital copy or a hard copy—whatever suits your needs. Enjoy the convenience of quick delivery and a hassle-free way to meet your stamp paper requirements.

The Jammu and Kashmir Stamp Act, Samvat 1977

The Jammu and Kashmir Stamp Act, Samvat 1977, was enacted to regulate the levy of stamp duties on various legal, financial, and commercial documents in the former state of Jammu and Kashmir. This Act was an adaptation of the Indian Stamp Act, 1899, but with provisions specific to the legal, social, and economic conditions of Jammu and Kashmir. The Act aimed to ensure proper documentation, legal validity, and revenue generation through stamp duty collection.

History of the Act

- Samvat 1977 (1920 A.D.): The Act was initially enacted during the princely rule in Jammu and Kashmir to address the need for a structured system of stamp duties.

- Special Status: Under Article 370, Jammu and Kashmir had its own laws, including a separate stamp duty framework.

- Post-2019 Changes: After the abrogation of Article 370 in August 2019 and the reorganization of Jammu and Kashmir into a Union Territory, the Indian Stamp Act, 1899, was extended to the region, replacing the Jammu and Kashmir Stamp Act, Samvat 1977.

Key Features of the Act

-

State-Specific Provisions: The Act included provisions tailored to the socio-economic and administrative requirements of Jammu and Kashmir.

-

Stamp Duty Rates: Rates were determined based on the type of document and the transaction value, focusing primarily on property transactions, agreements, and legal deeds.

-

Revenue Generation: The Act was a significant source of revenue for the state government, contributing to public welfare and infrastructure development.

-

Legal Compliance: Properly stamped documents were essential for their legal validity and enforceability in courts of law.

Purpose of the Act

- Revenue Collection: The stamp duties collected under the Act were a major source of revenue for the state.

- Legal Validity: The Act ensured that documents were properly stamped to make them legally enforceable.

- Transparency: By regulating stamp duties, the Act brought transparency to financial and property transactions.

Stamp Duty Rates under the Act

The following table provides an overview of the stamp duty rates that were applicable under The Jammu and Kashmir Stamp Act, Samvat 1977. These rates were indicative and varied based on the type of document and transaction value.

| Document Type | Purpose/Description | Stamp Duty |

|---|---|---|

| Sale Deed | Transfer of property ownership | 5% of property value |

| Gift Deed | Transfer of property as a gift | 3% of property value |

| Lease Agreement | Legal agreement for the use of property | 1% of average annual rent + deposit |

| Power of Attorney (General) | Authorization to act on someone’s behalf | ₹200/- |

| Power of Attorney (Specific) | Authorization for a specific purpose | ₹100/- |

| Partnership Deed | Agreement detailing terms of a partnership | ₹500/- |

| Mortgage Deed | Agreement for mortgaging property | 0.5% of loan amount (max ₹10,000) |

| Partition Deed | Document for dividing property among parties | 1% of property value (min ₹50) |

| Will | Legal document for transferring assets after death | ₹100/- |

| Bond | Financial agreement outlining obligations | ₹2/- for every ₹1,000/- |

| Certificate of Sale | Document certifying property sale | ₹2/- for every ₹1,000/- |

| Release Deed | Document releasing someone from a claim or obligation | ₹100/- |

| Acknowledgment of Payment | Document acknowledging receipt of payment | ₹10/- |

| Exchange of Property | Transfer of property through exchange | 3% of property value |

| Adoption Deed | Legal document formalizing adoption | ₹200/- |

| Notarial Act | Legal act performed by a notary public | ₹10/- |

Compliance Process

- Valuation Check: Property and financial transactions were verified to ensure that the declared value matched the market value.

- Reassessment: If undervaluation was suspected, authorities reassessed the value and levied additional stamp duty.

- Payment of Additional Duty: Any difference in stamp duty had to be paid before completing the registration process.

Post-2019 Developments

- After the reorganization of Jammu and Kashmir into a Union Territory in 2019, the Indian Stamp Act, 1899, was extended to the region, replacing the Jammu and Kashmir Stamp Act, Samvat 1977.

- The updated framework under the Indian Stamp Act ensures uniformity in stamp duty laws across the country while retaining state-level flexibility.

How does Estamper.in work?

Step 1: Visit eStamper.in

Start by visiting our website, eStamper.in, where you can easily navigate through our streamlined platform designed for a hassle-free experience.

Step 2: Select the State

Choose the state for which you need to purchase the e-stamp paper. Stamp duty rates vary depending on the state, and this selection helps us ensure compliance with local regulations.

Step 3: Select the Stamp Duty Amount

Next, select the amount of e-stamp paper you need to purchase. Whether it's for a rental agreement, affidavit, or property deed, we’ve got you covered with a variety of options.

Step 4: Checkout and Make the Payment

Proceed to checkout and complete the payment through our secure payment gateway. We accept multiple payment methods like credit/debit cards, UPI, and net banking for your convenience.

Step 5: Associate Reaches Out for Details

Once your payment is confirmed, one of our associates will contact you to gather the necessary details for generating your e-stamp paper. This ensures all required information is accurately captured.

Step 6: E Stamp Paper is Generated and Sent to You

After you provide the required details, your e-stamp paper will be promptly generated and sent to you. You can choose to receive it as a digital copy, which will be delivered to your email within a short time.

Step 7: Request a Physical Copy (If Needed)

If you also need a physical copy of the e-stamp paper, you can request shipping from our associate. The hard copy will be sent to your address for a minimal shipping cost, ensuring you have it in hand when needed.

Why Choose eStamper.in for Your E Stamp Needs?

-

Quick and Hassle-Free Process

At eStamper.in, we prioritize your time. Our streamlined platform ensures you can order and receive your e-stamp papers within just 15 minutes, saving you from long queues and complicated procedures. -

Digital and Hard Copy Options

Whether you need an instant digital copy or a hard copy delivered to your doorstep, we’ve got you covered. Enjoy the flexibility to choose the format that best suits your requirements. -

Secure and Legally Compliant

All e-stamp papers provided by eStamper.in are 100% authentic and comply with government regulations, ensuring your documents are legally valid and enforceable. -

Affordable and Transparent Pricing

We offer competitive rates with no hidden charges, making it easy and affordable for individuals and businesses to access their stamp paper needs. -

Wide Range of Services

eStamper.in caters to a variety of requirements, including agreements, affidavits, property deeds, lease contracts, power of attorney, and more. Whatever your need, we have the right solution for you. -

User-Friendly Platform

Our website is designed to provide a seamless user experience, making it simple for everyone—from individuals to businesses—to place their orders quickly and efficiently. -

Reliable Customer Support

Have questions or need assistance? Our dedicated customer support team is always ready to help, ensuring you have a smooth and stress-free experience. -

Access Anytime, Anywhere

With eStamper.in, you can order your e-stamp papers from the comfort of your home or office. No more running to physical vendors—our service is available 24/7 for your convenience. -

Environmentally Friendly

By offering digital e-stamp papers, we support eco-friendly practices, reducing the need for paper and contributing to a sustainable future. -

Trusted by Thousands

Join the growing community of satisfied customers who trust eStamper.in for their e-stamp needs. Our reputation for reliability, speed, and quality speaks for itself.

Conclusion

The Jammu and Kashmir Stamp Act, Samvat 1977, served as a critical legal framework for regulating stamp duty in the region for nearly a century. It helped ensure proper documentation, legal compliance, and transparency in transactions while contributing to state revenue. With the extension of the Indian Stamp Act, 1899, the region now follows a standardized framework, bringing it in line with the rest of India. Residents and businesses are encouraged to comply with the updated stamp duty regulations to avoid penalties and ensure the validity of their documents.